The Digital Giant You Can't Ignore

At the beginning of 2025, China crossed a remarkable threshold: 1.1 billion internet users. To put that in perspective, that's more than the United States and European Union combined. While localities and provinces are diverse, all these users are contained within a single market with a unified language and increasingly sophisticated digital infrastructure.

In 2024, China's online retail sales hit ¥15.5 trillion yuan (approximately $2.16 trillion USD), cementing its position as the world's largest online retail market for the thirteenth consecutive year. The China Commerce Ministry projects even more growth, with online retail sales reaching an estimated high of $2.66 trillion by the end of 2025.

For Western businesses eyeing international expansion, these figures represent an enormous opportunity. But like anything worth doing, the actual process isn’t so easy. Despite thousands of failed attempts, businesses consistently underestimate the process: you can't simply translate your existing website, point it at Chinese servers, and expect success. China's internet operates on fundamentally different infrastructure, regulations, and user expectations than the Western web you're accustomed to.

I learned this firsthand during my time as a student at NYU Shanghai from 2018 to 2020. Landing in China and suddenly having zero access to Google, Gmail, YouTube, or virtually any Western platform I'd taken for granted was a jarring experience in just how different the Chinese internet functions. From fumbling around Alibaba’s ordering system to mastering the craft of delivering McDonald’s to my dorm room, I learned that the apps were fundamentally different. The design patterns were different. The speed expectations were different. Everything I thought I knew about how websites should work needed recalibration.

This guide distills what I learned - combined with exhaustive research on current requirements - into a comprehensive “ultimate” roadmap for Western businesses looking to establish a legitimate web presence in China. We'll cover everything from hosting infrastructure and regulatory compliance to design philosophy and search engine optimization. By the end, you'll understand not just what to do, but why each element matters.

Understanding the Great Firewall: Why You Need a Separate Strategy

When most Westerners hear "Great Firewall of China," they think of blocked social media: no Facebook, no Twitter, no Instagram - the list goes on and on. That's true, but even then, it dramatically undersells the implications for business websites.

The Great Firewall doesn't just block entertainment platforms. It affects core web infrastructure that Western developers take for granted: Google APIs, Google Fonts, Google Analytics, Google Maps, YouTube embeds, and countless other services that many websites rely on without even thinking about it.

If your current website uses any Google services (and statistically, it almost certainly does), it will either break entirely or load painfully slowly in China. We're not talking about minor inconveniences here. A website that takes 15+ seconds to load because it's trying to reach blocked Google Font servers isn't a functional website. It's a bounce rate generator. As an added kicker, it’ll look terrible too once it might load.

This is why launching in China requires a fundamentally different approach than localization for other markets. When you expand to Germany or Brazil, you translate content, adjust cultural references, and modify some imagery. The underlying technical architecture remains largely unchanged.

China demands much more. Think of your China web presence not as a translated version of your existing site, but as a parallel product built for a parallel internet ecosystem. Just as different cultures develop different design languages, Chinese web design evolved to meet distinctly different user expectations. Your strategy must account for this from the ground up.

Hosting Infrastructure: China vs. Hong Kong vs. Singapore

One of your first major decisions involves where to physically host your China-facing website. Each option carries distinct tradeoffs in performance, regulatory burden, and flexibility. Let's examine them honestly.

Option A: Mainland China Hosting

Hosting directly in mainland China delivers the best possible performance: 1-20ms load times for users across the country. For businesses where speed directly impacts conversion rates (e-commerce, SaaS applications, media-heavy sites) this performance advantage is significant.

There’s a catch though. Mainland hosting requires an ICP (Internet Content Provider) license from China's Ministry of Industry and Information Technology. We'll detail the ICP process in the next section, but understand that it introduces regulatory complexity and ongoing compliance requirements.

Best for: Businesses committed to China as a primary market who are willing to navigate regulatory requirements for optimal performance.

Option B: Hong Kong Hosting

Hong Kong occupies a unique position as it’s technically part of China but operating under different internet regulations. No ICP license is required for Hong Kong hosting, making it the path of least regulatory resistance for foreign businesses.

Hong Kong connects to mainland China via China Telecom's CN2 GIA (ChinaNet Next Carrying Network Global Internet Access) network, delivering respectable latency: approximately 15-20ms to southern China (Guangzhou, Shenzhen) and 30ms+ to central and northern regions (Beijing, Shanghai). However, these speeds require optimization for the CN2 GIA network. Without it, latency can spike to 50ms or higher.

As with all good things, there are still several risks to consider. Content hosted in Hong Kong can still be blocked by the Great Firewall if deemed politically sensitive, and your website will be blacklisted on China’s internet. Hong Kong servers also experience short-term speed fluctuations during evening rush hours when network congestion peaks. Furthermore, space is a premium, so large datacenters are forced to charge higher costs to cover their rent.

Best for: Businesses wanting China market access without full regulatory commitment, or those serving both Chinese and international audiences.

Option C: Singapore Hosting

Singapore offers a budget-friendly alternative to Hong Kong with some unique advantages. Latency to mainland China runs approximately 30ms, which is slower than Hong Kong but still serviceable. However, where Singapore shines is stability: the country has invested billions of dollars into international bandwidth and network infrastructure, resulting in more consistent performance without the evening rush hour fluctuations common to Hong Kong.

Singapore also provides excellent connectivity to Southeast Asia (approximately 30ms to Malaysia, Thailand, and Indonesia), making it attractive for businesses targeting multiple Asian markets simultaneously.

One important consideration: Singapore's Personal Data Protection Act (PDPA) imposes very strict data privacy requirements. Your website and any associated applications must meet these security and privacy benchmarks - potentially requiring additional development work.

Best for: Businesses targeting both China and Southeast Asia, or those prioritizing stability and cost efficiency over raw speed without an ICP.

Making Your Decision

Here's a simple decision framework:

- China-only audience + willing to obtain ICP license → Mainland China hosting

- China + international audience → Hong Kong hosting + Chinese CDN

- China + Southeast Asia on a budget → Singapore hosting + Chinese CDN

Regardless of where you host, pair your infrastructure with a Chinese CDN (Content Delivery Network) for local caching and faster delivery. Major options include Alibaba Cloud, Tencent Cloud, Baidu Cloud, ChinaCache, and BaishanCloud. A Chinese CDN can significantly improve performance even when your origin server sits outside mainland China.

ICP Licensing Demystified

If you've researched China web hosting at all, you've encountered the term "ICP license." It's often presented as an impenetrable bureaucratic barrier, but understanding what it actually requires and who actually needs it clarifies your options considerably.

What Is an ICP License?

An ICP (Internet Content Provider) license is essentially permission from China's Ministry of Industry and Information Technology (MIIT) to operate a website within mainland China. Think of it as China's version of a medieval guild certification - a credentialing system that signals legitimacy and earns trust from both search engines and users. Without it, your site risks shutdown or censorship if hosted on mainland Chinese servers. It’s also vital for Chinese SEO as well.

Two Types of ICP Licenses

Non-Commercial ICP

This license covers content and informational websites that don't engage in e-commerce or any financial transactions. Eligibility requirements include any of the following: a Chinese citizen with a state-issued passport, a foreign individual residing inside China, or a Wholly Foreign-Owned Enterprise (WFOE) registered in China.

Commercial ICP

This license is required for any website conducting e-commerce, processing payments, or generating revenue directly through the site. The eligibility requirements here are significantly stricter: you must be a Chinese-owned business with a Chinese business license, or a foreign business where a Chinese company holds at least 51% ownership.

That 51% requirement is why many foreign businesses cannot easily obtain commercial ICP licenses. It effectively requires either establishing a joint venture with Chinese majority ownership or finding creative corporate structuring solutions: neither of which is trivial.

The Hong Kong Workaround

Most foreign businesses initially bypass ICP requirements entirely by hosting in Hong Kong. This approach offers several advantages. It has faster setup, lower costs, more flexibility in content, all while still providing reasonable access to mainland Chinese users.

The tradeoffs, as discussed earlier, include slightly slower load times, the risk of Great Firewall blocking if your content touches politically sensitive topics, and diminished SEO on Baidu and other Chinese search engines. For the majority of business websites, these risks are manageable when they’re first entering the market.

If this sounds complicated, that's because it is. Welcome to doing business in China. The regulatory landscape rewards those who invest time understanding the rules, or those who partner with experienced local advisors who already do.

Replacing Blocked Services: Your Chinese Tech Stack

Remember those Google dependencies I mentioned earlier? Here's where we address them systematically. If your current website uses Google Fonts, Google Maps, YouTube embeds, Google Analytics, or reCAPTCHA, those elements will fail or severely degrade performance in China. You need to use Chinese alternatives.

The following bullet points provide direct substitutions for common Western services:

Blocked Service Chinese Alternative(s)

- Google Fonts: Useso, or self-host font packages locally

- Google Maps: Gaode Maps/Amap (Alibaba), Baidu Maps, Tencent Maps

- YouTube/Vimeo: Bilibili, Tencent Video

- reCAPTCHA: GeeTest, NetEase CAPTCHA (163)

- Google Analytics: Baidu Tongji, CNZZ, Umeng (Alibaba)

- Gmail/Email APIs: QQ Mail, 163 Mail (NetEase), Alibaba Mail

A critical note on implementation: this isn't a simple find-and-replace operation. Each Chinese service has its own API documentation, authentication requirements, and integration patterns. Budget adequate development time for this transition. Rushing it leads to half-functional features that frustrate users and undermine trust.

Chinese Web Design Principles: What Users Actually Expect

Here's where cultural assumptions can trip up even technically competent teams. Western designers often approach Chinese localization with Western aesthetic assumptions: clean minimalism, generous white space, and restrained color palettes. These instincts, while valid for Western audiences, can actually work against you in China.

Mobile-First Is Non-Negotiable

China has over 1.25 billion mobile users. Read that number again. Mobile isn't just important in China: it's the default assumption. Design for mobile as the primary experience, with desktop as a secondary consideration. Any approach that treats mobile as an afterthought is fundamentally misaligned with how Chinese users access the web.

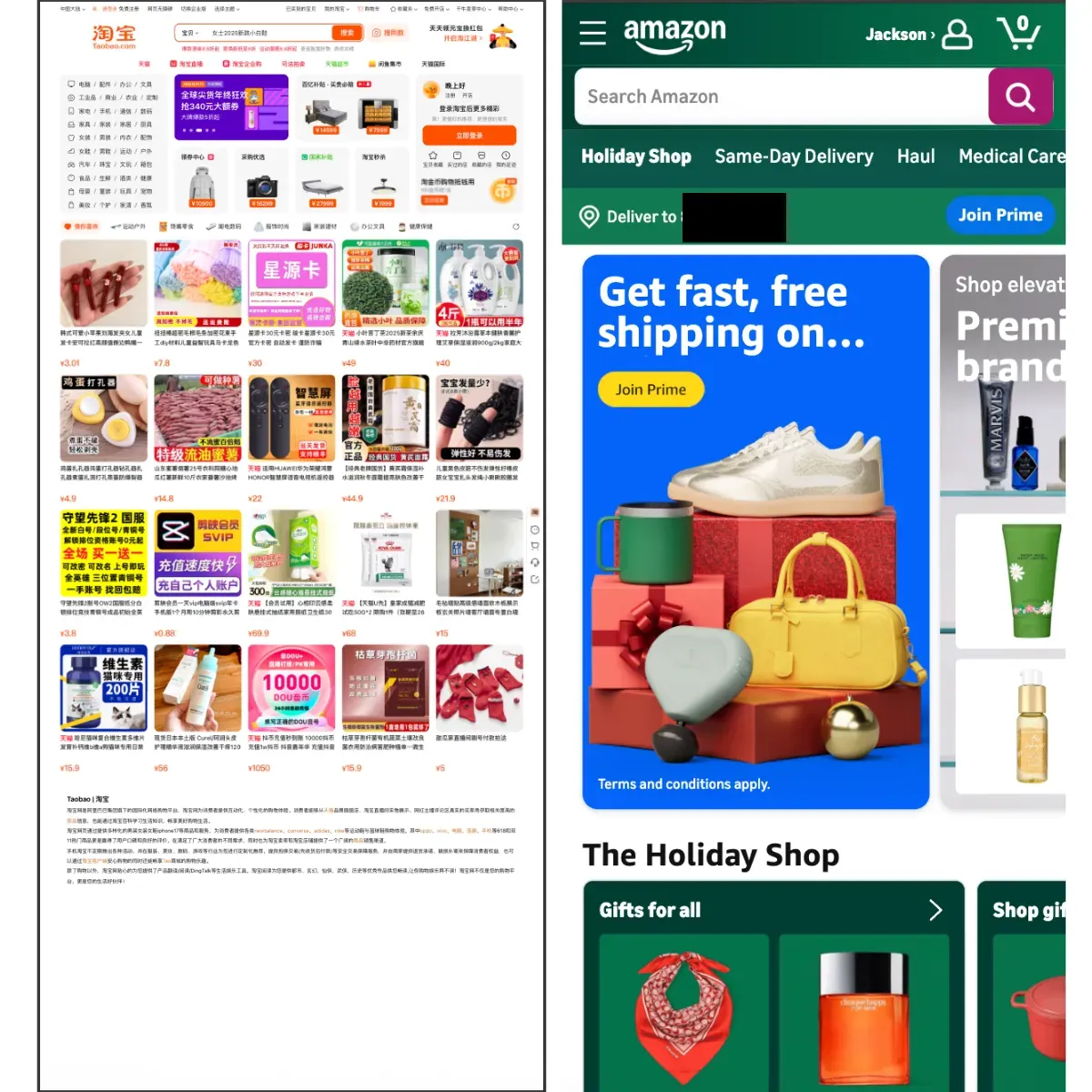

Aesthetic Preferences Differ from Western Minimalism

Chinese users generally prefer colorful, information-dense designs. Where a Western designer might leave generous negative space, Chinese users often interpret that as wasted real estate. It looks like a site that hasn't been fully developed or doesn't have enough to offer.

Color serves a functional purpose in Chinese web design, strategically highlighting important information and guiding user attention. This isn't supposed to be "cluttered" though. It's meant to be information-rich by design, so the aesthetic reflects a culture that values efficiency and immediate access to relevant details.

As you can see from the image above, Taobao (the #1 online retailer in China) looks considerably more information dense than Amazon!

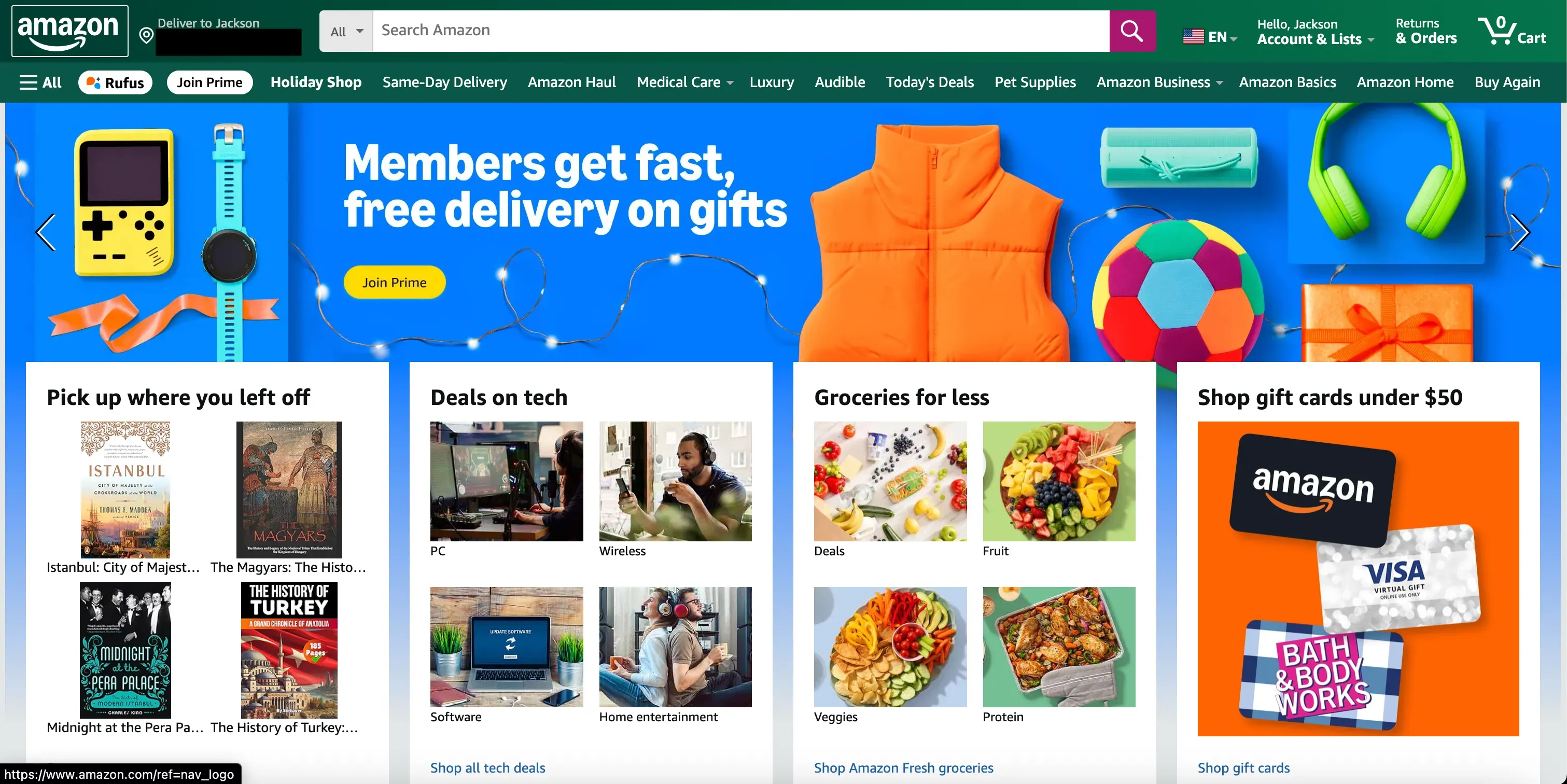

Navigation Patterns

Chinese websites typically provide multiple navigation touchpoints, enabling users to shortcut to information quickly rather than following a prescribed linear journey. Links often open in new tabs, enabling comparison shopping and parallel browsing. Pages tend to be shorter and more topic-specific (roughly two full screen lengths or less) rather than the long-scroll single-page designs popular in Western web trends. Below is another comparison of the navigation on Taobao and Amazon - you'll notice Taobao is very dense and provide all the relevant information.

Trust and Engagement Signals

Live chat support is expected, not optional. Chinese consumers want immediate responses to questions, so waiting 24-hours for an email reply feels unacceptably slow. If you can't staff live chat during Chinese business hours, consider AI-powered chat solutions that can handle common queries.

QR codes appear everywhere as well, especially on desktop versions of the site, bridging users to mobile experiences, such as app downloads, WeChat follows, and promotional offers. E-commerce sites deploy aggressive promotional strategies as well, which have been adopted in the West in recent years. Flash sales, loyalty rewards, group discounts, daily deals, and lotteries are commonplace. Chinese consumers are trained to look for deals and feel sophisticated when they find them.

Typography Considerations

Chinese characters are visually more complex than Latin alphabet letters, containing more strokes within the same space. This means it’s imperative to maintain a minimum 12px font size for readability, and test character rendering across devices. What looks crisp on your development machine may become illegible on lower-resolution mobile screens.

As an example of a character, take a look at the image below depicting the character for "bíang". This is meant to symbolize a Shaanxi style noodle dish called "bíang bíang miàn".

Baidu SEO: Playing by Different Rules

While Google holds an 85.05% market share in the US, things operate much differently in China. As of November 2025, Baidu commands approximately 64% of search market share, followed distantly by Bing at 16%, Haosou at 9%, Yandex at 6%, and Google barely limping along at 2%. Your SEO strategy must prioritize Baidu. This is tricky because Baidu operates differently than Google in several important ways.

.cn Domain Authority

Baidu gives ranking preference to .cn domains. This isn't subtle either: it's a measurable factor in search visibility. Securing a .cn domain that matches your business signals commitment to the Chinese market and builds trust with the search engine, the Chinese government, and Chinese users. It's worth the investment.

ICP Status Affects Rankings

Sites with ICP licenses rank higher on Baidu. Even if you're hosting in Hong Kong and don't strictly require an ICP license for operation, obtaining one (if you qualify) provides significant SEO benefits.

Meta Tags Still Matter

Unlike Google, which largely ignores meta keywords, Baidu still uses meta tags and keywords as ranking signals. Don't skip this "old school" SEO tactic of deploying meta keywords. It directly impacts your Baidu visibility in ways it wouldn't for Google.

JavaScript Is Problematic

Baidu's web crawler (Baiduspider) doesn't handle JavaScript well. If your site relies heavily on JavaScript frameworks (React, Vue, Angular) for rendering content, ensure all important content and links are available in static HTML. Implement server-side rendering if you're using modern JavaScript frameworks. Otherwise Baidu may not see your content at all.

Mobile Optimization

Like Google, Baidu favors mobile-optimized sites, aligning with the mobile-first design principles discussed earlier. This isn't just about responsive design: Baidu looks for genuine mobile optimization in page speed, touch targets, and mobile user experience.

Link Building Strategy

Backlinks matter significantly to Baidu, similar to Google. High-value backlinks come from government websites (.gov.cn), universities (.edu.cn), established news outlets, and popular industry blogs. Working with local PR agencies can help establish these relationships. In fact, cold outreach from foreign companies rarely succeeds.

Technical Checklist for Baidu

- Ensure your site uses HTTPS encryption

- Submit your XML sitemap to Baidu Webmaster Tools

- Update content regularly to signal that your site is actively maintained

- Use native Chinese speakers for keyword research. Search behavior in Chinese differs significantly from English

Social and Payment Integration: Meeting Users Where They Are

Chinese users don't sign in with Google or Facebook. They also don't pay with Visa or PayPal. Meeting Chinese users where they are means integrating with the platforms they actually use.

Social Login Integration

WeChat and Weibo are the dominant platforms for social registration and login in China. This would be the equivalent to "Sign in with Google/Facebook" functionality in the West. QQ, Youku, and Douyin (the Chinese version of TikTok) offer additional integration options depending on your target demographic.

WeChat deserves special attention. With over a billion monthly active users, it's less a social network than a digital lifestyle platform. Consider building a WeChat Mini Program alongside your main website. These lightweight apps within WeChat can handle everything from e-commerce to customer service without requiring users to leave the WeChat ecosystem.

Payment Integration

Alipay and Tenpay (WeChat Pay) dominate both desktop and mobile payments in China. Credit cards are far less common than in the West. In fact, many Chinese consumers have never owned one. If you're conducting any form of e-commerce, integrating these payment methods isn't optional.

Localization Beyond Translation

True localization extends far beyond running your content through a translation service. It's a form of accessibility by making your content truly accessible to users whose cultural and linguistic context differs from your own.

Copywriting, Not Just Translation

Hire native Chinese copywriters, not just translators (or worse, plugging your existing site copy into Google Translate!). Marketing copy, tone, and cultural references need localization, not just linguistic accuracy. A phrase that resonates emotionally in English may fall flat, or worse, sound awkward, when directly translated. Use Simplified Chinese for mainland audiences (Traditional Chinese is used in Taiwan and Hong Kong).

Formatting Details That Matter

- Currency: Display prices in ¥ (CNY)

- Date format: 年月日 (year/month/day)

- Address format: Country → Province → City → District → Street (opposite of Western convention)

- Name format: Family name first (Zhang Wei, not Wei Zhang)

Cultural Considerations

Color symbolism differs between cultures. Red signifies luck and prosperity in China (hence its prevalence in Chinese New Year and wedding imagery), while white can carry associations with mourning in certain contexts. Imagery and examples should reflect Chinese contexts. Stock photos of American office workers won't resonate.

Furthermore, align your promotional calendar with Chinese holidays. Singles' Day (November 11) has become the world's largest shopping event: bigger than Black Friday and Cyber Monday combined! Chinese New Year, Mid-Autumn Festival, and other traditional holidays offer promotional opportunities that Western holiday calendars miss entirely.

Your China Website Launch Checklist

Here’s a consolidated actionable checklist you can work through systematically.

Phase 1: Strategic Decisions

☐ Define your China market commitment level (testing vs. primary market)

☐ Decide hosting location (Mainland China / Hong Kong / Singapore)

☐ Determine if ICP license is needed and feasible for your business structure

☐ Secure a .cn domain

Phase 2: Technical Infrastructure

☐ Set up hosting with Chinese CDN integration

☐ Audit current site for Google and other blocked service dependencies

☐ Implement Chinese alternatives for all blocked services

☐ Ensure site uses HTTPS encryption

☐ Implement server-side rendering if using JavaScript frameworks

Phase 3: Design and Content

☐ Redesign for mobile-first experience

☐ Adapt visual design for Chinese aesthetic preferences

☐ Hire native Chinese copywriters for content creation

☐ Implement live chat functionality

☐ Add QR codes for mobile bridging where appropriate

Phase 4: SEO and Integration

☐ Conduct keyword research with native Chinese speakers

☐ Optimize meta tags and keywords for Baidu

☐ Submit sitemap to Baidu Webmaster Tools

☐ Integrate WeChat/Weibo login options

☐ Set up Alipay/Tenpay payment processing (if applicable)

Phase 5: Launch and Maintain

☐ Test thoroughly from within China (VPN testing or China-based testers)

☐ Establish regular content update schedule

☐ Begin link building with local PR outreach

☐ Monitor performance via Baidu Tongji analytics

Conclusion: The Long Game

Let's be honest. Launching a website in China is more complex than expanding to virtually any other market. The regulatory requirements are intense. The technical adaptations are substantial. The cultural learning curve is steep.

But the opportunity is proportional to the effort. Over a billion internet users, a multi-trillion-dollar e-commerce market, and a digital ecosystem that rewards businesses willing to meet users on their terms. These statistics represent real customers, real revenue, and real competitive advantage for businesses that get this right.

The businesses that succeed in China are those that treat it as a distinct market deserving dedicated strategy, not an afterthought tacked onto their international expansion plans. They invest in understanding the infrastructure, the regulations, the design expectations, and the cultural context. They build relationships with local partners. They commit to the long game.

Start with the fundamentals. Get your hosting sorted, replace your blocked dependencies, and optimize for mobile. Then layer in sophisticated Baidu SEO and social integrations as you learn what works for your specific audience. Test, iterate, and stay patient. Chinese consumers reward brands that demonstrate genuine commitment to serving them well.

The Chinese internet isn't going anywhere. If anything, its influence and sophistication will only grow. The question isn't whether your business should eventually establish a presence in China. It's whether you'll start building that foundation now or scramble to catch up later.

Ready to discuss your China web strategy? Launch Turtle specializes in helping businesses navigate international expansion. Get in touch to explore what's possible for your brand in the Chinese market.

Works Cited

- The State Council of the People's Republic of China. "China's Internet Users Reach 1.1 Billion." January 18, 2025.

- The State Council of the People's Republic of China. "China Becomes Largest Online Retail Market for 13 Consecutive Years." January 25, 2025.

- Reuters. "China Targets Online Retail Sales of $2.66 Trillion by 2025." October 26, 2021.

- GSMA. "The Mobile Economy: China."

- Dataplugs. "Hong Kong Server vs United States Server: A Comprehensive Speed Comparison."

- JTTI. "Server Location Comparison: Hong Kong vs Singapore."

- StatCounter Global Stats. "Search Engine Market Share in China."

- Sinorbis Blog. "Western and Chinese Web Design: What You Need to Know."

- The Dim Sum. "How to Make a Chinese Website in 2023."

- EC Innovations. "China SEO: Essential Steps for Baidu Optimization."

Weekly Insights

Get actionable web development tips that actually work. No fluff, just proven strategies.

Join 5,000+ developers and business owners worldwide

Weekly insights • No spam • Unsubscribe anytime

Jackson White

Content Creator

Jackson is the founder and lead developer at Launch Turtle, bringing over 4 years of technical expertise to help small and mid-sized businesses establish powerful online presences. Let's Launch!